The Cash "Broker"

Recently, I was reading an article in the Wall Street Journal about how some Financial Advisors ‘sweep’ their clients’ cash into their investment firms’ high interest savings fund and the client gets a miniscule rate. As I read the article, I was astonished that Brokers (Financial Advisors) can get away with giving their clients less than 1% interest on cash, even as low as 0.15%!

When it comes to rates on cash balances, there are many options that financial advisors can offer to their clients. High Interest Savings are pretty much available at all financial institutions to park funds and those accounts have full liquidity. Some financial institutions offer higher rates on cash deposits than others and it is up to your financial advisor to show you all of the rates available, not just what is available at their own firm. Financial Advisors have the fiduciary duty to act in the best interests of the client, not the best interests of their investment firm.

Many people will go to a Mortgage Broker when they are looking for a new mortgage or looking to renew their mortgage. Typically, a mortgage broker has relationships with many banks and financial institutions, so they are able to provide you with a variety of options and rates.

Our cash management practice is similar to a mortgage broker business, in that we have relationships with over 30 banks and financial institutions and ‘shop’ to get you the best rates on your cash deposits. Working within your cash needs and cash flow, we can offer a variety of cash investment products including GICs, High Interest Savings, Money Markets and other Fixed Income investments. When dealing with a financial advisor at a bank, typically they may only offer you their own cash products and rates for your cash. As mentioned in the Wall Street Journal article, many financial institutions encourage their Brokers just to offer their own cash products in order to maximize their firm’s profitability.

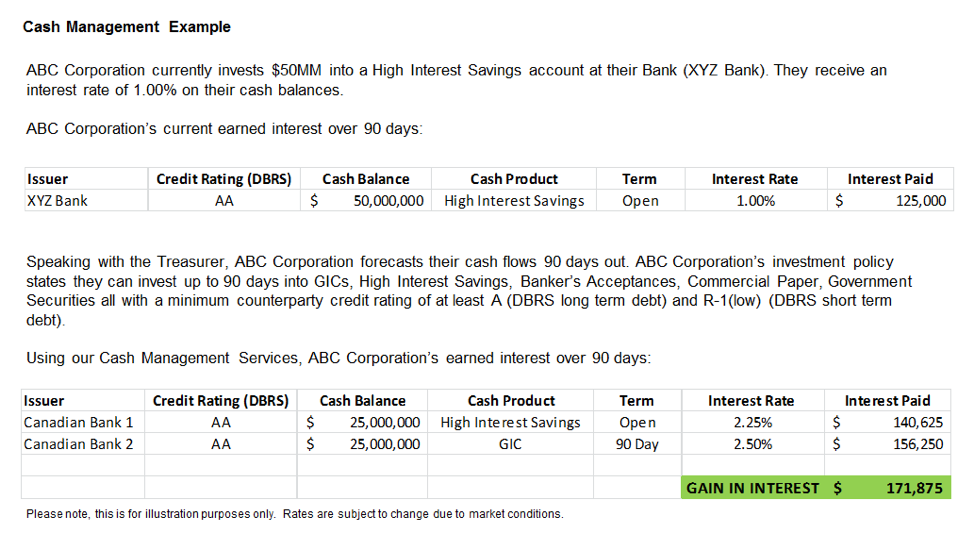

Many companies have cash sitting in their current accounts at the bank which is getting them very little interest. We can offer them cash products from the same bank that they have their current accounts with but get them a higher rate without taking any risk.

Banks typically have their own mortgage agents who will only offer you the bank’s mortgage products. You’ll also have to do all of the negotiating with the bank yourself to try and get the best rate. Mortgage Brokers, on the other hand, compare products from a number of different banks and specialty lenders, and negotiate the best rate for you. Just like Mortgage Brokers, we give our clients cash products from different banks and financial institutions, comparing the rates and negotiating to get our clients the highest rates on their cash. Our advantage is that we are independent and unbiased when it comes to investing your cash and will shop to get you the highest rates!

In the above example, we were able to diversify the company’s concentration risk from having all of their cash deposits in one bank to multiple banks and diversifying their investment mix into other cash products, hence getting them a high rate on their cash without taking any additional risk.

If you are looking to get a better rate on your company’s cash than what your bank is currently offering, please contact us today for a rate quote!